BILL HWANG GOT 18 YEARS

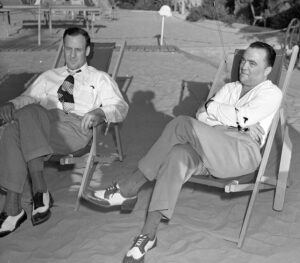

BILL HWANG AND HIS LAWYER AFTER HE WAS SENTENCED TO 18 YEARS IN PRISON

BY THE LEGAL EAGLE

In a stunning fall from grace, Bill Hwang, a once-prominent hedge fund manager, was convicted on nine of ten charges in a case that has captivated financial and legal communities alike. Hwang, the founder of Archegos Capital Management, was charged with market manipulation, securities fraud, and the theft of $20 billion in a scheme that unraveled in 2021. The conviction marks a dramatic conclusion to a saga that saw one of the finance world’s brightest stars fall into disgrace after a high-profile collapse.

Archegos Capital Management, founded by Hwang in 2013, was initially hailed as a hedge fund with massive potential. Hwang, a former Tiger Management analyst, employed a strategy that involved using highly leveraged investments, primarily through derivatives like total return swaps, to build massive positions in several large companies. His fund’s portfolio included stocks of firms like ViacomCBS, Netflix, and Discovery. At its peak, Archegos was estimated to manage around $35 billion in assets. However, its reliance on borrowed capital to amplify returns led to the fund’s downfall in March 2021, when its highly leveraged positions began to unravel.

The implosion of Archegos sent shockwaves through the global financial system. When stock prices of companies that Archegos had large stakes in began to fall, the fund’s lenders — including major Wall Street banks like Credit Suisse, Nomura, and Morgan Stanley — were forced to liquidate the positions to cover the losses. The sell-off caused billions of dollars in losses, with Credit Suisse alone losing $5.5 billion. Archegos, with its web of secretive and complex trading strategies, had concealed the extent of its market manipulation, leading to massive losses for both investors and banks.

Hwang’s method of controlling massive positions through swaps, which allowed him to avoid disclosure rules required for traditional equity holdings, was at the heart of the allegations against him. Prosecutors argued that Hwang used these financial instruments to artificially inflate the stock prices of the companies he was betting on, creating the illusion of value and manipulating the market to benefit his fund. This hidden leverage, prosecutors claim, allowed Hwang to mislead investors and inflate the value of his portfolio beyond what was sustainable.

The charges against Hwang included conspiracy to commit securities fraud and market manipulation. He was accused of using his position to manipulate the prices of stocks, and in doing so, he allegedly defrauded investors, banks, and regulators. The scale of the fraud was immense, with losses attributed to his actions reaching up to $20 billion. The manipulation was so significant that it took a full-scale investigation by the U.S. Department of Justice and the Securities and Exchange Commission to untangle the web of deceit Hwang had created.

The collapse of Archegos also led to the firing and legal action against several high-level executives, including those at the banks involved in facilitating the trades. The case brought to light the dangers of high-risk, high-reward trading strategies that relied on opaque financial instruments and minimal regulatory oversight. It raised questions about the practices within hedge funds and the broader financial industry, particularly regarding the potential for systemic risk posed by such large and highly leveraged positions.

Hwang’s arrest followed a lengthy investigation, which uncovered a trail of deceit and manipulation that spanned several years. Authorities allege that Hwang and his team misled both regulators and investors, systematically disguising the true nature of their trades. The charges against him reflect the severity of the alleged theft, which prosecutors believe caused significant harm not only to the victims involved but also to the integrity of financial markets as a whole. Despite his attempts to defend himself by citing his religious beliefs and motivations, the court found him guilty of the vast majority of the charges.

The aftermath of Hwang’s conviction has left many in the financial industry reeling. The case serves as a cautionary tale of unchecked ambition and the risks of opaque financial instruments. The $20 billion theft and the subsequent arrest of Hwang have sparked renewed discussions about the need for more stringent regulation of hedge funds and the role of high-leverage trading in global markets. For Hwang, the conviction signals the end of what was once a promising career, and a reminder that even the most sophisticated financial strategies can have disastrous consequences when driven by greed and deceit.

Hwang’s co-defendant, former Archegos Chief Financial Officer Patrick Halligan, was convicted at the same trial on three criminal charges. His sentencing is scheduled for January 27. Both chose not to testify at their two-month trial.