FROM PR TO FL: Why GHR moved from Puerto Rico to Florida, USA

GHR.NETWORK is a utility coin originally registered in Puerto Rico with the intention of taking advantage of the island government’s offering to bring in new business with their “A60” Program… The very attractive program offered:

- 100% Tax Exemption on Dividends and Interest.

- New Residents would enjoy a 100% tax exemption from Puerto Rico income taxes on all dividend and interest income.

- Interest and dividends that qualify as Puerto Rico source income will not be subject to federal income taxation under Section 933 of the U.S. Tax Code.

- 100% Tax Exemption on Capital Gains from Securities and Digital Assets (“Eligible Investments”).

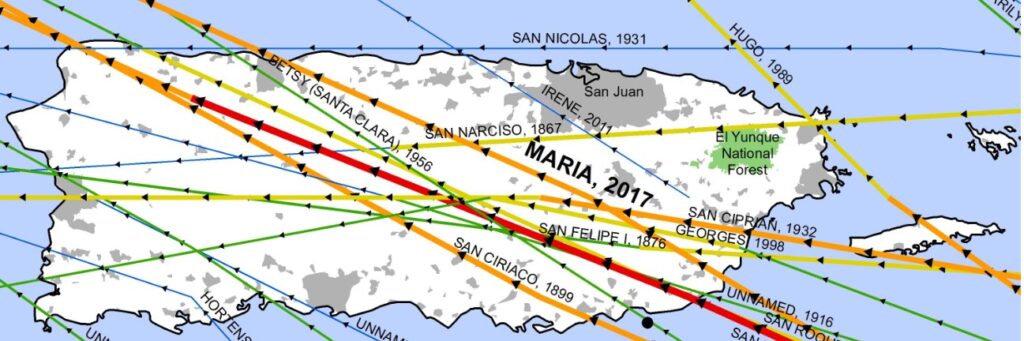

What Puerto Rico’s marketing professionals do not mention is that the island has been subject to a multitude of hurricanes, regional tornadoes, Category 4 and 5 storms and the subsequent flooding that bad weather creates.

The poor weather conditions have devastated the island’s business infrastructure. Roads are washed out and the entire business and residential electrical power customer base has become so accustomed to losing power on a daily basis that they’ve made the 3-to-5 hour (or more) loss of power segments part of the local language. Power outages are now referred to as “apagones” because they’re now a “normal” event (not the exception).

Unfortunately for our corporation and many other foreign based businesses that made a decent attempt to register their businesses in Puerto Rico, GHR has been unable to convince any Puerto Rico based bank to grant the corporation a routine business checking account. Between the phones ringing on until a voicemail came on and not having the calls returned, my confidence in obtaining a Puerto Rico based corporate checking account got weaker and weaker.

Banks have forwarded their business calls to their employee’s cell phones but that only works if there is electrical power in their respective employee’s neighborhood trunk lines. Successful calls are also dependent on whether or not bank employees have had sufficient electrical power during the week in their homes enabling them to re-charge their cell phones.

Our hats are off to all the businesses now enjoying the A60 program. GHR Corporation was unable to do so.

In the meanwhile, a US-Canadian Joint Venture (LUMA) is attempting to rectify a phone system built 81 years ago. We wish them great success and good weather.

And we can’t ignore that Hurricane Maria devastated the internet systems in Puerto Rico in September 2017. Luckily for Puerto Rico, the U.S. FCC offered $950 million in 2019 to repair Puerto Rico and the Virgin Islands’ Internet. When those repairs will take place is anyone’s guess.

Today’s Technology, Internet and Crypto related business environments are not for the faint of heart or people averse to change.

Years ago, our crypto interests were focused in a most unique cryptocurrency that carried 9 Australian patents. it was called Bankcoin Reserve. I loved BCR’s patents (especially one written specifically to address Sharia Law)

Unfortunately, BCR’s originators could not get the coin on a day-to-day exchange. It was always placed on cryptocurrency exchanges based in countries that did recognize U.S. law. That key point made it impossible for our corporation to continue with the BCR coin. The company attorneys cited reasons why we had to give up the BCR USA business. We shut it down that week!

While we loved the coin, we couldn’t work with it. The coin was one of the originals but had never been upgraded or revamped (not ever). We needed a coin that recognized U.S. law, was built with a proper Smart Contract and had all the latest hoots-and-whistles.

We chose to build a utility token (GHR) that we owned in its entirety (thereby enabling the corporation to always be in compliance). Not having to depend on third parties meant we could stay in compliance all of the time and not be worried that someone not in agreement with us, could do business in a contrary way than our business model.

We continued on as the GHR Utility Coin and one of our customers entered into a SAPI contract with GHR Corporation providing 5,000 acres of a popular skiing and snowboarding property that GHR now carries as an Asset Under Management.

The best online definition of a SAPI contract is found at the MONDAQ website; Mexico Is Trending – SAPIS: A Tailor-Made Solution For Investors – International Trade & Investment – United States (mondaq.com)

The GHR SAPI Contract was initiated in 2021 (lasting 50 years) guaranteeing the GHR business a large percentage of future revenue until 2071.

And we have now re-registered the GHR Corporation of Puerto Rico in the State of Florida as the GHR GLOBAL HUMANITARIAN RESERVE CORPORATION.

Then, in November of 2022, FTX happened to the cryptocurrency industry. Who expected such a convoluted situation to emerge from such a seemingly promising business as FTX and Alameda Research?

Luckily for our business, we had refocused our efforts towards Real Estate and away from cryptocurrency.

Utility coins are an excellent tool for circular economies (highly popular and profitable in retail settings).

But in the meanwhile, GHR is working with Real estate. Land may seem extremely old fashioned, but it has been used as a means of fortifying businesses for centuries. Throughout history, land ownership has been a symbol of wealth and power, and owning valuable real estate has been a way for businesses to secure reliable financial security.

One of the earliest examples of real estate being used for business purposes can be found in ancient civilizations. In ancient Egypt, for example, the pharaohs controlled vast amounts of land and used it as a way to exert power and control over the population. Similarly, in ancient Rome, wealthy patricians used their landholdings as a way to gain political influence and maintain social status.

As civilization progressed, the use of real estate for business purposes has continued to evolve. In medieval Europe, the feudal system relied heavily on land ownership, with lords and nobles controlling vast estates and using them to generate income through agriculture and other means. In the 19th century, the Industrial Revolution saw the rise of factories and industrial complexes, which were often built on large tracts of land.

In more recent times, real estate has continued to play a vital role in the business world. The rise of commercial and residential property development has created a lucrative industry, with businesses buying and developing land for a variety of purposes. Real estate investment trusts (REITs), allow individuals to invest in a portfolio of properties, and they have become increasingly popular in recent years as a way to invest in the real estate market. GHR has not set up an REIT but it has established a proper way for anyone to join GHR.

GHR.NETWORK’s Utility Token is backed by 5,000 acres worth of land. This means that the value of the GHR utility token is directly linked to the value of the land, providing a tangible asset to back it.

This is a great example of how real estate can be used to fortify a business and provide a sense of security for investors.

Real estate has been playing a vital role in fortifying businesses throughout history. From ancient civilizations to modern times, land ownership has been a symbol of wealth and power and it has been used as a means of generating income and securing financial futures.

GHR.NETWORK’s Utility Token is a great example of how Real Estate can be used to fortify a high-tech business and provide a sense of security for investors in the present day.

When all else fails, Real Estate is still one of the firmest financial structures the world has ever had. It is held in the same high esteem in all countries worldwide. GHR is a private corporation, and it will remain so for the near future.